I often get asked about junior doctor salary rates. Personally, I hate the term “junior doctor”. Most trainee doctors I know are very mature and have often had a meaningful adult life before medicine. But unfortunately, this appears to be the most common term used for the group of doctors who are “pre-specialist”. So here is a comprehensive breakdown for you. Along with some additional interesting observations.

As of 2025 If you are an intern doctor in NSW (postgraduate year 1) you are earning an annual full-time salary (before tax) of $76,000 AUD and you are officially on the lowest-paid junior doctor salary in Australia. On the other end of the spectrum if you are living in Western Australia and are a Senior Registrar Year 2, then you are on $192,371 AUD of annual junior doctor salary. And you are officially the best-paid trainee doctor in Australia. Although, because you have been at this training gig now for about 10 years. It is very likely that a lot of your colleagues have finished being trainee doctors by now and are earning far superior salaries as specialists.

The rest of you are somewhere in between in your junior doctor salary. And if you refer to this handy table below you will be able to see how much salary you should be making (at least officially). And if you are thinking about moving States or Territories or are an IMG doctor thinking about working in Australia. You can also use this table to get a bit of an estimate of your salary expectations. But be warned some employers are known to play it hardball and discount your prior clinical experience and try to start you off on lower salary rates.

So how much does a junior doctor in Australia make? What is the lowest salary for a junior doctor in Australia? And what does a first year doctor salary in Australia look like? You can answer all of these questions in the table below. And if you would prefer this in hourly or monthly rates we have these covered in tables at the end of this post.

[ninja_tables id=”128185″]*Western Australia pays a significantly higher rate for doctors working for the Country Health Service north of the 26 degree latitude. Intern annual salary is $119,165 and Senior Registrar as much as $293,564 as of September, 2025

Thanks to one of our readers that pointed out we had the incorrect rates for WA Health in a previous version.

Sources:

| NSW | Victoria | Queensland | Western Australia | South Australia | Tasmania | ACT | Northern Territory | General Practice |

By the way. This is one of those posts where if you spot something wrong or out of date. I would really love to know. Leave me a comment below.

So let’s cut to the chase what does every trainee doctor in Australia earn? Or. What does their junior doctor salary look like?

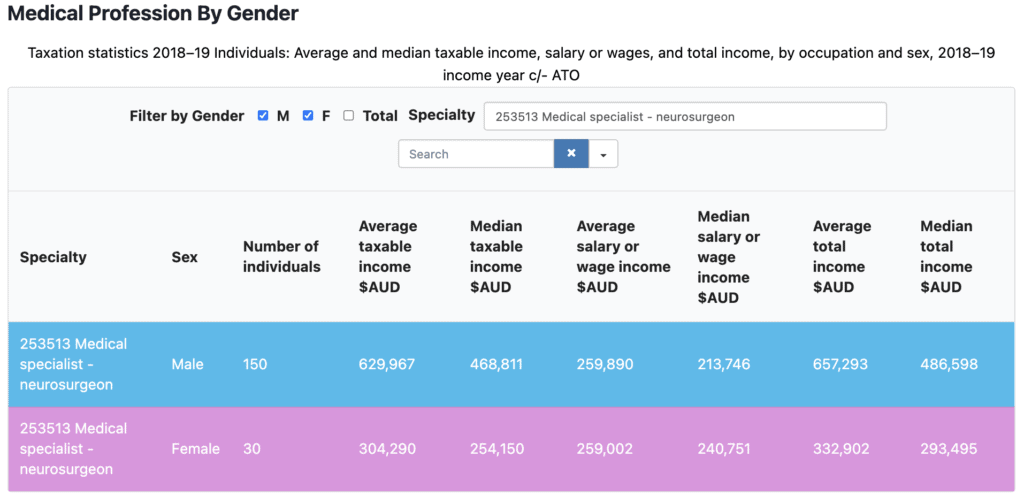

How do these junior doctor salary rates compare with reported incomes?

Now. Please bear in mind I have just shown you the official annual junior doctor salary for each trainee doctor type in Australia. I have even included for you General Practice Registrar’s Salaries, with thanks to the GP Registrars Association. But these are baseline salaries. They are the junior doctor salary you would get paid if you came to work from 8.30 to 5 pm each weekday. had a half-hour lunch break. Left on time every day. Took your 4 weeks of annual leave and a monthly rostered day off. And never worked an evening or overnight shift or weekend overtime or on-call.

We all know that working as a trainee doctor is just not like that. i.e. these are not the true take-home junior doctor salary rates.

To work out what these look like we need to dig a little deeper. One additional source of data is the Australian Taxation Office.

What does the Australian Taxation Office say about junior doctor salary rates in Australia?

According to Australian Taxation Office data

Resident Medical Officers earned an average of $128,145 AUD of average taxable income in the 2021 to 2022 financial year. Which is approximately the current annual pay rate of a first year Registrar in Victoria or a third year registrar in New South Wales, again employed full-time.

However, due to the way, the classification system works it’s not clear whether this category includes all trainee doctors. The figure is based upon 16,883 individual tax returns.

According to. the Health Workforce Data Set in 2019, there were 16,526 Specialists in Training in Australia. Along with 12,098 Hospital Non-Specialists, a category that mostly includes prevocational trainee doctors, i.e. interns and resident medical officers. There were also 31,102 General Practitioners, a category that will include GP trainees.

So were are likely comparing some apples with some oranges here.

But the point is that there are probably another 15,000 – 20,000 tax returns completed by medical practitioners who are specialists in training, where they put a different occupation group down. on their form. Presumably the specialty they were training in.

So the ATO data will likely reflect a junior doctor salary of a doctor in their earlier years of training. And are therefore fairly consistent with the salary rates in the big table above.

The Junior Doctor Awards and Enterprise Agreements

The other source of information is the Junior Doctor Awards and Enterprise Agreements.

If you are an international reader you may be a little unfamiliar with the concept of an Award or Enterprise Agreement.

In Australia, responsibility for industrial law is primarily the responsibility of State and Territory governments. Which explains why pay rates and conditions for doctors vary so widely in the above table.

Awards are legal documents that outline the minimum pay rates and conditions of employment for certain categories of employees. Awards apply to employers and employees depending on the industry they work in and the type of job worked. Awards are authorised through a special legal court of law called an Industrial Relations Commission.

For much of Australia’s history Awards were the main form of employment agreements. In the 1990s Enterprise Agreements were introduced.

Awards don’t apply when an employer has an Enterprise agreement in place. Enterprise agreements set out minimum employment conditions and can apply to one business or a group of businesses.

So the main difference between these two documents is Awards apply to the whole industry whereas Enterprise Agreements apply to a business or group of businesses.

In essence, these legal documents look and read very similar to each other. Despite the ability to have Enterprise Agreements now in several States and Territories, there has only ever been one Enterprise Agreement for doctors working in public hospitals per State or Territory.

Overtime, Penalty Rates and On-Call

In Australia, it has been the historical practice that employees are further compensated for having to work additional or extra hours (commonly referred to as overtime). For these additional hours, you will generally get paid somewhere between 50% more (commonly referred to as time and a half) or 100% more (referred to as double time).

Shift work and penalty rates are important aspects of employment for trainee doctors, especially in healthcare services where hospitals operate around the clock.

Shift Work for Trainee Doctors:

- Nature of Shift Work: Trainee doctors often work in shift patterns to ensure continuous patient care. These shifts can include regular daytime hours, as well as evening, night, and weekend shifts. Shift work may also involve being on call, where the doctor must be available to work if needed.

- Rostering: Shifts are usually determined by a roster set out by the hospital or healthcare facility. This roster aims to balance the training needs of the doctor with the operational requirements of the hospital.

- Duration and Frequency: The duration of shifts can vary, but long shifts (sometimes 12 hours or more) are not uncommon in the medical field. The frequency of shifts, including night and weekend work, depends on the hospital’s policies and the specific department.

Penalty Rates for Trainee Doctors:

- What Are Penalty Rates?: Penalty rates are higher rates of pay that are provided to employees for working outside of normal working hours, such as late nights, weekends, or public holidays. They are designed to compensate for the unsocial hours and increased demands of working these periods.

- Calculation of Rates: Penalty rates are typically calculated as a percentage above the standard pay rate. For example, a trainee doctor might receive a 150% pay rate (time and a half) for working on a weekend or a 200% rate (double time) for public holidays.

- Variation by State and Sector: Penalty rates can vary depending on the state or territory in Australia, as well as whether the doctor is working in the public or private sector.

- Impact on Income: For many trainee doctors, penalty rates can significantly increase their income, reflecting the demanding nature of their work schedule.

It’s important for trainee doctors to be aware of their work conditions, including shift patterns and entitlements to penalty rates, as these significantly impact their work-life balance and overall compensation. These details should be clearly outlined in their employment contracts and governed by the relevant industrial agreements.

Finally, you may be required to be on-call as part of your job. This is often the case for Registrars who are covering certain specialties in the hospital, where the hospital does not generally need a trainee to be in the hospital all of the time. Typical examples would be psychiatry or gastroenterology or Ear Nose and Throat Surgery. Traditionally, this was intended to be for the purpose of “calling you back in” so you could review an urgent patient after hours. Nowadays with ith the advent of improved telecommunications being on-call is often for the purpose of giving advice about the patient, without necessarily needing to go back in.

On-call arrangements are probably one of the most hated components of Awards or Enterprise Agreements. As an example, being on-call in NSW attracts a very paltry $16.60 for a 24-hour period if you were already on duty that day. This does not include payments for attending whilst on-call which are covered by overtime. But it’s not a lot of money if all you are doing is giving phone advice all night. The situation is similar in Queensland, Western Australia and Victoria. Although Victoria at least has a clause about limiting the number of unnecessary phone calls.

When one considers overtime, penalty rates and on-call one can see how your take-home junior doctors salary pay will likely lift significantly with even a few additional hours per week which is quite common for most trainee doctors.

Other Benefits to Bear in Mind

There are a range of other benefits and leave entitlements that you will normally be eligible for whilst working as a trainee doctor in Australia.

The National Employment Standards and Trainee Doctors.

Trainee doctors like all employees in Australia are supported under a national set of common employment conditions

The National Employment Standards (NES) in Australia significantly impact trainee doctors, providing a foundational framework for their employment conditions. These standards offer a set of minimum entitlements that apply to all employees, including those in the healthcare sector. Here’s how they specifically affect trainee doctors:

- Working Hours and Rest Breaks: The NES sets limits on weekly working hours and mandates rest breaks and days off. This is crucial for trainee doctors, who often work long and irregular hours, helping to prevent burnout and ensuring they can provide quality care.

- Annual Leave: Trainee doctors are entitled to four weeks of paid annual leave per year, as per the NES. This ensures they have adequate time for rest and recuperation, away from the demanding hospital environment.

- Personal/Carer’s and Sick Leave: The NES allows for 10 days of paid personal/carer’s leave per year, plus additional unpaid carer’s leave if needed. This is vital for trainee doctors to manage their health and care responsibilities.

- Parental Leave: Trainee doctors are entitled to unpaid parental leave for the birth or adoption of a child. This includes maternity, paternity, and adoption leave, ensuring they can spend time with their new child without the fear of losing their job.

- Public Holidays: The NES provides for paid leave on national public holidays, a benefit that contributes to the work-life balance for trainee doctors.

- Notice of Termination and Redundancy Pay: These provisions under the NES protect trainee doctors in cases of job termination or redundancy, ensuring fair treatment and adequate notice or compensation.

- Flexibility in the Workplace: The NES allows for requests for flexible working arrangements, which can be particularly beneficial for trainee doctors balancing work with training or family commitments.

- Long Service Leave: While governed more specifically by state legislation, the NES acknowledges long service leave, allowing trainee doctors to accumulate leave over time for extended breaks.

In essence, the NES provides a safety net of minimum employment conditions for trainee doctors, helping to safeguard their well-being and rights in a demanding and often high-pressure profession. It ensures a degree of uniformity and fairness across the healthcare sector and supports the sustainability of medical careers in Australia.

Below is a more fuller description of each benefit available.

Superannuation

Superannuation is a pension program in Australia, designed to provide retirement income to our citizens. It is a compulsory system where employers are required to make contributions to a superannuation fund on behalf of their employees. This fund accumulates over time and is invested, with the aim to grow the savings for the employee’s retirement. As of July 2023, the current superannuation guarantee rate is 11% of an employee’s ordinary time earnings. This means employers must contribute an amount equal to 11% of their employees’ salaries and wages into their superannuation fund, ensuring a secure financial foundation for their retirement years. This rate of superannuation is expected to reach 12% by July 2025.

Higher Duties Allowances and In-Charge Allowances

A “higher duty allowance” and an “in charge allowance” are types of additional payments commonly found in various employment sectors, including healthcare. They usually amount to a few tens or hundreds of dollars extra per shift. Here’s a brief explanation of each:

- Higher Duty Allowance: This is a type of compensation provided to an employee when they temporarily take on higher-level responsibilities or duties that are above their regular job classification. For instance, in a healthcare setting, a nurse or a doctor might receive a higher duty allowance when they temporarily fill a position at a higher level, such as acting in a managerial or specialized role. This allowance is meant to compensate for the increased workload and the higher level of responsibilities.

- In Charge Allowance: This allowance is typically given to an employee who takes on the role of being ‘in charge’ of a shift, unit, or department, often in the absence of the regular supervisor or manager. In healthcare, this could apply to a nurse or other medical professional who oversees the operations of a ward or unit during a particular shift. The allowance is a recognition of the additional responsibilities and decision-making requirements that come with managing operations and supervising other staff in the absence of the usual leadership.

Both allowances are ways of acknowledging and compensating employees for taking on more significant responsibilities, either on a temporary or ongoing basis, and are important for morale and motivation in the workplace.

Travel and Accommodation Allowances

Travel and accommodation allowances are forms of financial reimbursement provided to employees to cover expenses incurred when they are required to travel for work purposes. Here’s a brief overview of each:

- Travel Allowance: This allowance is designed to cover the cost of travel-related expenses, such as transportation, meals, and incidental costs, incurred by an employee while traveling for work. It can be structured in various ways: as a per diem, where a set daily amount is provided; as a reimbursement for actual expenses based on receipts; or as a mileage allowance for using a personal vehicle. For example, a doctor who needs to attend a medical conference in a different city might receive a travel allowance to cover airfare, taxi fares, and meals.

- Accommodation Allowance: This allowance specifically covers lodging expenses when an employee is required to stay away from their usual place of residence due to work-related travel. It is intended to cover costs such as hotel or motel charges and may sometimes include additional funds for meals if not already covered under a separate travel allowance. An example would be providing a healthcare professional with an accommodation allowance when they are sent to a rural area for a temporary assignment or training.

If you area a trainee doctor and you are seconded to another region for a short stint as part of your employment contract (for e.g. 13 weeks or 6 months) you will generally be offered accommodation by the hospital you are working at. It’s unusual to be offered subsidy to find your own accommodation. But as a past medical administrator I have approved such requests when the trainee has given me reasonable notice (I had a trainee who wanted to rent a place he could have his pet at as part of a required rural rotation. He gave me about a year’s notice so I was happy to negotiate with the local manager and arrange an approval for this).

Both allowances are important for ensuring that employees are not financially disadvantaged when they are required to travel for their job. They are typically governed by the government employment agreements (awards and enterprise bargain agreements), and may also be subject to tax considerations depending on the regulations in the specific country or region.

Professional Development, Learning, Training, Exam Leave

Other Award and Agreement conditions vary somewhat between State and Territory. Over the past few years most States and Territories, with the notable exception of NSW have brought in some form of paid professional development funding and leave for trainee doctors. For example, Victoria might be considered the most progressive jurisdiction due to the fact that it provides for both a professional development allowance and professional development leave for all trainee doctors, including interns.

[ninja_tables id=”128917″]Employee Assistance Programs and Trainee Doctors

Employee Assistance Programs (EAPs) are supportive services offered by employers, including healthcare institutions for trainee doctors, to assist employees with personal or work-related issues that might impact their job performance, health, and well-being. EAPs are a critical resource in high-stress professions like healthcare.

- Scope of Services: EAPs typically offer a range of confidential and free counseling services, addressing issues such as stress, mental health, family problems, financial concerns, and workplace conflicts. These programs are designed to provide short-term support, with referrals to more specialized services if needed.

- Accessibility and Confidentiality: One of the key features of EAPs is their confidentiality, ensuring that employees can seek help without fear of stigma or repercussions at work. Services are often available 24/7, providing easy and immediate access for employees.

- Professional Support: EAPs are usually staffed by trained professionals like psychologists, counselors, and social workers who are equipped to provide expert assistance and guidance.

- Benefits for Trainee Doctors: For trainee doctors, EAPs are especially beneficial. The medical field can be exceptionally demanding, with long hours, high-stress situations, and emotional challenges. EAPs offer a valuable outlet for managing these pressures, promoting mental health and resilience.

- Workplace Well-being: EAPs contribute to a healthier workplace by addressing the root causes of work-related stress and improving overall employee well-being. This, in turn, can lead to increased job satisfaction, higher productivity, and reduced absenteeism.

- Preventive Approach: By providing early intervention, EAPs help prevent the escalation of issues, supporting not just the individual employee but also the broader workplace environment.

Some employers choose to go beyond free professional counseling programs and offer other additional employee benefits, such as on-site recreational facilities or access to reduced cost gym memberships.

Employee Assistance Programs are an essential part of modern employee benefits packages, reflecting a holistic understanding of the interplay between personal well-being and professional performance. For trainee doctors, EAPs represent a crucial support system, aiding them in navigating the complexities of both their professional and personal lives.

Other Types of Leave for Trainee Doctors in Australia

Doctors coming from most other countries will be surprised how many actual days of leave workers in Australia get. There are a plethora of leave types many of them quite standard across all sectors of the workforce.

Annual Leave

In Australia, the annual leave entitlements for trainee doctors, like all employees, are governed by national employment standards and specific industry agreements. Here’s how it typically works:

- Entitlement: Trainee doctors in Australia are usually entitled to four weeks of paid annual leave per year. This entitlement is a standard in line with the National Employment Standards (NES) set forth by the Fair Work Act.

- Accrual: Annual leave accrues progressively during the year, based on the number of normal hours worked (additional hours and overtime do not count).

- Taking Leave: To take annual leave, trainee doctors generally need to request and have their leave approved by their employer. This process often requires consideration of the staffing needs of the hospital or healthcare facility, as well as the educational requirements of the trainee’s program.

- Payment During Leave and Leave Loading: While on annual leave, trainee doctors are paid at slightly higher than their regular base pay. The standard rate for leave loading is often 17.5% of the employee’s ordinary earnings. This means that when an employee takes annual leave, they receive their usual pay plus an additional 17.5%. The leave payments do not include overtime or other special allowances they might normally receive.

- Public Holidays: Public holidays that fall during a period of annual leave do not typically count as annual leave days. So you do not lose a day if your annual leave falls on a public holiday.

- Carry-over and Cashing Out: Depending on the terms of their employment and relevant industrial agreements, trainee doctors may be able to carry over unused annual leave to the next year or, in some cases, cash out their unused leave.

It’s important to note that specific details can vary depending on the state or territory, the healthcare institution, and any applicable enterprise agreements or contracts. Trainee doctors should refer to their individual employment contracts and consult with their HR department for detailed information regarding their annual leave entitlements.

Rostered Days Off

Rostered Days Off (RDOs) are scheduled days when an employee is not required to work, despite normally being part of their regular work schedule. This system is often used in industries with extended working hours or shift work, like healthcare, construction, or emergency services. Here’s how RDOs work for trainee doctors:

- Accrual: RDOs typically accrue over time. For instance, an employee might work extra hours each day or week, which then accumulate to provide a full day off on a regular basis. Typically trainee doctors in Australia work 40 hours of normal employment per week but are paid for 38 hours. The extra 2 hours goes towards their RDO.

- Scheduling: RDOs are usually planned and agreed upon in advance and are part of the employee’s work schedule or roster. This helps in ensuring that both the employer’s operational needs and the employee’s rest periods are balanced effectively.

- Purpose: The primary goal of RDOs is to provide employees with additional rest time, recognizing the demands of extended working hours or intense workloads. It’s a way to ensure work-life balance and reduce the risk of burnout, especially in high-stress jobs.

- Payment: Employees are typically paid for RDOs, as these days off are considered part of their normal working hours.

- Impact on Work Patterns: In sectors like healthcare, where staffing needs are constant, RDOs must be carefully managed to ensure that all shifts are adequately covered. This might involve rotating schedules or flexible staffing arrangements. In some parts of the hospital, such as operating theatres and clinics Low Activity Days maybe scheduled to allow employees to take RDOs.

Public Holiday Leave

As a trainee doctor in Australia you are entitled to leave for public holidays. If you are required to work on a public holiday you will be paid a higher rate than normal and accrue a leave day.

Australia has a variety of public holidays, which include both national and state/territory-specific holidays. The number and dates of these holidays can vary depending on the state or territory.

National Public Holidays:

- New Year’s Day (January 1st)

- Australia Day (January 26th)

- Good Friday (date varies each year as it’s based on the Christian calendar)

- Easter Monday (the day after Easter Sunday)

- ANZAC Day (April 25th)

- Christmas Day (December 25th)

- Boxing Day (December 26th)

Additional Public Holidays (Varies by State/Territory):

- Labour Day: Celebrated on different dates in different states.

- Queen’s Birthday: Usually observed on the second Monday in June, except in Western Australia and Queensland.

- Melbourne Cup Day: Only in Victoria, on the first Tuesday of November.

State-Specific Holidays:

- Each state and territory may have its own specific public holidays. For example, Adelaide Cup Day in South Australia, Canberra Day in the Australian Capital Territory, and Royal Queensland Show (Ekka) Day in Brisbane, Queensland.

Total Number of Public Holidays:

- The total number of public holidays can range from 8 to 13 days annually, depending on where one lives and works in Australia.

When a standard public holiday falls on a weekend, a substitute public holiday may be observed on the next non-weekend day, usually a Monday.

Sick Leave

Sick leave is a critical employment benefit that allows employees, including trainee doctors, to take time off work due to illness or injury without loss of income. In Australia, full-time employees are typically entitled to a set number of paid sick leave days per year, with the standard entitlement being 10 days per annum for full-time employees. Part-time employees receive a pro-rata amount based on their hours worked.

One of the key features of sick leave in Australia is its accumulative nature. If an employee doesn’t use all of their allocated sick leave in a given year, the unused days can be carried over to the next year, accumulating over time. This means that if an employee has a serious illness or injury that requires extended time off, they may have a reserve of sick leave days to draw from. Sick leave accumulation provides an important safety net, ensuring that employees do not suffer financial hardship due to illness or injury.

Long Service Leave

Long Service Leave (LSL) is an employment benefit with a unique and interesting history, particularly in Australia. Its origins are traced back to the 19th century and are closely linked to the country’s colonial past.

- Origins in Colonial Australia: Long Service Leave originated during the colonial era in Australia. It was initially introduced to allow public servants and later, other employees, the opportunity to visit their homelands, typically in the UK and Europe, after a period of service in Australia. Given the long sea voyage required at the time, an extended leave period was necessary.

- Evolution Over Time: Over the years, as travel times decreased and Australia’s identity and workforce evolved, so the purpose of LSL shifted. It became a means to acknowledge and reward long-term service and loyalty to an employer, and to provide an extended break for rest and rejuvenation.

- Legislation and Standardization: By the mid-20th century, LSL was legislated in various Australian states, with standard entitlements typically being after 10 years of continuous service. The specifics, such as the amount of leave and conditions for eligibility, can vary between jurisdictions and are outlined in employment laws and agreements.

- Global Perspective: While Long Service Leave is particularly characteristic of the Australian employment landscape, similar concepts do exist in other countries, albeit under different terms and conditions. For example, in some European countries, ‘sabbatical leave’ is offered, allowing for extended breaks for personal or professional development. However, the specific concept of LSL as it is known in Australia, particularly with its historical ties and specific conditions, is quite unique to the country.

Generally, most trainee doctors do not benefit from LSL as a trainee, as they are normally finished with their training before the 10 year period accumulates. However, because most trainee doctors work in the public sector, if you continue to work in the public sector as a Consultant you will shortly be eligible for LSL. And the bonus is that you will be paid at your current rate (e.g. Consultant rates).

A key aspect of long service leave, especially within the public sector, is its portability across government jobs. This means that when an individual moves from one government job to another, their accumulated long service leave entitlements can often be transferred or ‘ported’ to their new position. This portability ensures continuity of service benefits, recognizing the total contribution of an individual to public service, regardless of changes in specific government employment. The ability to port long service leave is particularly beneficial for professionals like trainee doctors who might move between different public hospitals or health services or states and territories, allowing them to retain and build upon their long service leave entitlements.

Family and Carer’s Leave

Family and Carers Leave is a provision in Australian employment law, designed to support employees, including trainee doctors, in balancing their work commitments with family responsibilities. This type of leave allows employees to take time off to care for a family member who is sick or needs assistance due to an unexpected emergency. Here’s a more detailed look:

- Entitlement: Under the National Employment Standards (NES), all Australian employees, including full-time, part-time, and casual employees, are entitled to unpaid carer’s leave. Full-time and part-time employees also have an entitlement to paid personal/carer’s leave.

- Paid Personal/Carer’s Leave: Full-time employees are typically entitled to 10 days of paid personal/carer’s leave per year, which can be used for their own illness or injury, or to provide care or support to a family or household member who is ill, injured, or experiencing an emergency. Part-time employees are entitled to a pro-rata amount based on their regular hours of work.

- Unpaid Carer’s Leave: In addition to the paid entitlement, employees can also take two days of unpaid carer’s leave whenever they need to care for a family member or a member of their household who is sick or in case of an emergency. This leave is available to all employees, including casuals.

- Notice and Evidence Requirements: Employees are required to notify their employer as soon as possible about the need to take carer’s leave and may need to provide evidence, such as a medical certificate, to support their leave request.

- Impact on Trainee Doctors: For trainee doctors, who often work in high-pressure environments with demanding schedules, access to family and carer’s leave is essential. It provides them with the flexibility to attend to personal and family health needs without the added stress of job insecurity or loss of income.

Parental Leave

Certainly. In Australia, trainee doctors, like all employees, are entitled to maternity, paternity, and adoption leave.

- Maternity Leave: Female trainee doctors in Australia are entitled to maternity leave as per the National Employment Standards (NES). Typically, they can avail up to 12 months of unpaid leave, with the possibility to request an additional 12 months. Additionally, they may be eligible for the Australian Government’s Paid Parental Leave scheme, which offers up to 18 weeks of pay at the national minimum wage. Some hospitals or health services may provide additional paid maternity leave benefits as part of their employment agreements.

- Paternity/Partner Leave: Male trainee doctors or partners, including same-sex partners, are entitled to paternity leave. Under the NES, they can take up to two weeks of paid leave at the national minimum wage under the Paid Parental Leave scheme (under most hospital agreements this will be paid at your normal rate). Fathers are also entitled to up to 12 months of unpaid leave to care for their child, which can be extended for another 12 months upon request.

- Adoption Leave: Trainee doctors who are adopting a child have similar entitlements to those on maternity or paternity leave. They can take up to 12 months of unpaid adoption leave, with the option to request an additional 12 months. The Paid Parental Leave scheme may also apply, offering financial support during the initial period following the adoption.

In all cases, there are specific eligibility criteria, such as length of service and the requirement to be the primary caregiver. Furthermore, many hospitals and health services have their own policies that might provide more generous leave provisions than the minimum standards. These leaves are crucial for trainee doctors, allowing them to balance their demanding professional responsibilities with significant family life events.

Defence Force Leave

Defence Force Leave is a special form of leave for trainee doctors, who are members of the Australian Defence Force (ADF) Reserve. This leave enables them to fulfill their defence force commitments without impacting their civilian employment. Here’s a detailed look:

- Entitlement and Purpose: Defence Force Leave allows reservists to take time off from their civilian job to engage in various Defence Force activities, including training and operational deployments. This leave is essential for reservists to fulfill their military obligations while maintaining their civilian careers.

- Types of Leave: The leave can be categorized into two types – voluntary and obligatory. Voluntary defence service includes activities like training and exercises, while obligatory service refers to situations where a reservist is called upon for operational duties.

- Duration: The duration of Defence Force Leave varies based on the nature and requirement of the military service. It can range from a few days for short training exercises to several months for operational deployment.

- Paid and Unpaid Leave: Some periods of Defence Force Leave may be paid leave, particularly for short-term commitments or annual training obligations. However, longer deployments or extended training might be unpaid. Specifics depend on the employer’s policies and the nature of the service.

- Job Protection and Benefits: Employees on Defence Force Leave are typically protected by legislation that ensures they can return to their civilian job with the same terms and conditions. Their absence for defence service does not adversely affect their career progression, including entitlements like annual leave accumulation.

- Significance for Trainee Doctors: For trainee doctors who are Defence Force reservists, this leave is particularly valuable. It allows them to continue their medical training and career development while also serving their country. Hospitals and healthcare employers usually have policies in place to support these dual responsibilities.

Family Violence Leave

Family Violence Leave is a relatively recent but vital addition to workplace entitlements in Australia. It is designed to support employees, including trainee doctors, who are experiencing family violence. This type of leave provides necessary time off to attend to issues arising from family violence, acknowledging the profound impact such circumstances can have on an individual’s life and work. Here’s an overview:

- Entitlement: Under the National Employment Standards (NES), employees, including trainee doctors, are entitled to unpaid family and domestic violence leave. This allows them to deal with the impact of family violence without the added worry of losing their job or income.

- Duration and Conditions: The NES provides for five days of unpaid leave per year, which can be taken in single or multiple-day spans. Employees are eligible for this leave from the day they start their job, and it doesn’t accumulate year-to-year if not used.

- Purpose of Leave: Family Violence Leave can be used for various purposes, such as making safety arrangements for the employee or a close family member, attending court hearings, or accessing police services. The aim is to provide time and space to manage the complexities and challenges that arise from such situations.

- Confidentiality and Sensitivity: Given the sensitive nature of family violence, requests for leave are handled with strict confidentiality. Employers are required to protect the privacy of the employee taking this leave.

- Importance for Trainee Doctors: In the demanding and high-stress environment of healthcare, having access to Family Violence Leave is particularly important. It ensures that trainee doctors dealing with family violence can seek support and manage their personal circumstances without fear of repercussion in their professional lives.

- Workplace Support: Many healthcare employers also offer additional support services, such as counseling or referral to professional help, to assist employees experiencing family violence.

Civic Duties

Civic Duty Leave in Australia encompasses not only Jury Service Leave but also provisions for other types of civic responsibilities, such as participating in elections or serving in emergency services. This is particularly relevant for employees like trainee doctors, who may need to balance these duties with their professional obligations. Here’s an overview:

- Jury Service Leave: As previously mentioned, this allows employees to fulfill jury duties without loss of income or job security. Employers often provide paid leave for a set period, and longer services might be compensated by the government.

- Election Duty Leave: Individuals involved in conducting or working at elections may be entitled to take leave from their jobs. This can include roles like polling station officers or electoral officials. In many cases, this type of leave is unpaid, but it allows employees to participate in the democratic process without fear of losing their job.

- Emergency Services Leave: Trainee doctors who are also members of volunteer emergency services, such as the State Emergency Service (SES) or rural fire services, may be entitled to leave for duties related to these roles. This leave is crucial during times of natural disasters or emergencies when these volunteers are called upon to provide essential services. Employers generally support this leave, recognizing the importance of these services to the community. In some cases, this leave may be paid, especially for extended emergency situations, or it may be unpaid but protected, ensuring job security.

- Other Civic Duties: This can also include other types of leave for civic responsibilities, such as attending mandatory government appointments or participating in community service activities.

Cashing Out Leave

Cashing out leave is a practice in Australian employment, including for trainee doctors, where employees can exchange a portion of their accrued leave entitlements for a corresponding financial payment. This option offers flexibility in managing leave balances and provides a financial benefit. Here’s a closer look:

- Types of Leave Eligible for Cashing Out: Typically, the types of leave that can be cashed out include annual leave. It’s important to note that not all types of leave, such as personal/carer’s leave, are eligible for cashing out.

- Conditions and Limits: Cashing out leave is subject to certain conditions to ensure that the employee’s well-being and leave entitlements are not adversely affected. For instance, an employee must retain a minimum balance of annual leave (often four weeks) after the cashing out. Additionally, there are often limits on the amount of leave that can be cashed out in a given year.

- Employment Agreements and Policies: The specifics of cashing out leave, including the rate of payment and any restrictions, are typically outlined in the relevant industrial awards, enterprise agreements, or employment contracts. It’s important for trainee doctors to refer to these documents to understand their specific entitlements and conditions.

- Voluntary Agreement: Cashing out leave must be a mutual agreement between the employer and the employee. It cannot be forced or demanded unilaterally by either party.

- Benefit for Trainee Doctors: For trainee doctors, who may accrue significant amounts of leave due to demanding work schedules, the option to cash out can provide a welcome financial boost. It can be particularly beneficial in circumstances where taking time off might not be feasible due to work commitments or training requirements.

- Tax Implications: The cashed-out portion of leave is treated as income and is subject to taxation. Employees should be aware of these implications when considering cashing out their leave.

Cashing out leave is a practical option that provides financial flexibility to employees, including those in demanding fields like medical training, while ensuring that their primary entitlement to rest and recuperation through leave is preserved.

Junior Doctor Salary NSW, Junior Doctor Salary Victoria, Junior Doctor Salary Qld, Junior Doctor Salary WA, Junior Doctor Salary SA, Junior Doctor Salary Tas, Junior Doctor Salary ACT, Junior Doctor Salary NT