A couple of years ago I wrote this post reflecting the fact that according to the Australian Taxation office doctors are extremely well paid in Australia. This blog is both an update to that post. But also a focus on who are the highest paid doctors in Australia? This time I am going to try to go into more detail as I had lots of questions last time, likes “what about pathologists?” or “I’m a neurosurgeon is that any different from an orthopaedic surgeon.

First for the overview:

Just like 2 years ago if we look at things at a macro level not much has changed and doctors still maintain their high rankings in the ATO data, with Surgeons sitting at number 1 on an average taxable income of $394,303 AUD. Followed by Anaesthetists at number 2 on $386,065 AUD, Internal Medicine Specialists at number 3 on $304,752 AUD and Psychiatrists ($235,558 AUD) and Other Medical Specialists ($222,933 AUD) at 5th and 6th. Just squeezed out for number 4 by Financial Dealers. This is in fact the same as it was 2 years ago.

But if we go down to a more granular level and look at subclassifications where Surgeons are divided into specialties like Neurosurgery and Orthopaedics and Internal Medicine Specialists are divided into specialties like Cardiology and Paediatrics we see that some medical specialists do even better with medical professionals dominating 34 of the top 50 occupations for average taxable income in Australia.

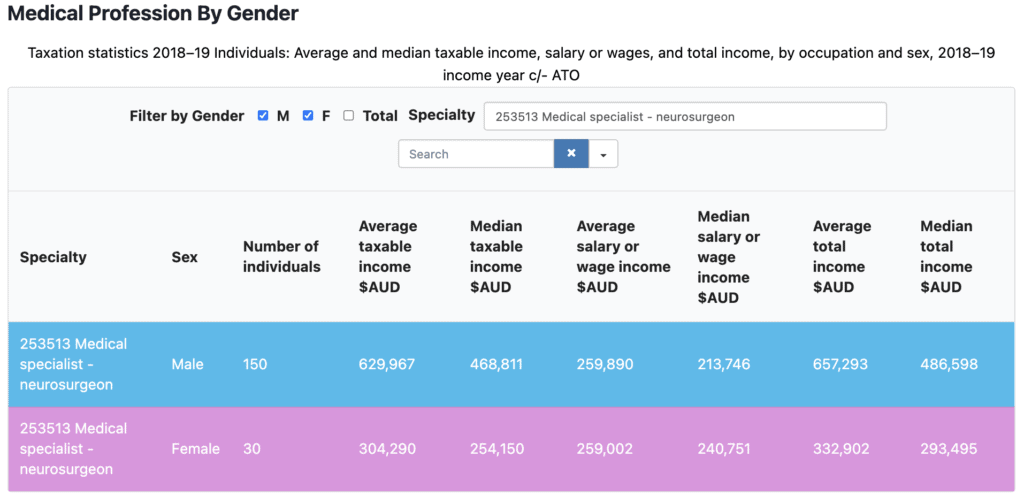

With the highest paid occupations and the highest-paid doctors being Neurosurgeons coming number 1 at $575,687 AUD, followed by Ophthalmologists at 2 with $524,804 AUD and Ear Nose and Throat Surgeons 3 at $468,525 AUD. What is also interesting is the huge discrepancy in earnings between male and female doctors of all specialties with a male Neurosurgeon earning more than double the average taxable income of a female Neurosurgeon $629967 AUD vs $304,290 AUD.

Read on further for some further analysis and discussion about medical specialist salary in Australia.

Australia’s Highest Paid Doctors Still Do Very Well in Comparison to Other Occupation Groups

Here’s a list of the top ten occupation groups by Average Taxable Income for 2018 to 2019 (the most up to date figures).

[ninja_tables id=”126355″]Surgeons sit at number 1 on the list on an average taxable income of $394,303 AUD. Followed by Anaesthetists at number 2 on $386,065 AUD, Internal Medicine Specialists at number 3 on $304,752 AUD and Psychiatrists ($235,558 AUD) and Other Medical Specialists ($222,933 AUD) at 5th and 6th. Just squeezed out for number 4 by Financial Dealers. This is in fact the same as it was 2 years ago.

In fact, according to the ATO Surgeons have been topping the list (for occupation groups) since 2010.

Now some of you with a keen eye will have noticed that if we look at the fifth and final column would have noticed that if we go on median taxable income then it is actually the Surgeons colleagues the Anaesthetists who are the better paid. What’s all that about then?

Well, first we have to understand what is meant by taxable income.

According to the ATO: Your taxable income is “the income you have to pay tax on” (d’oh!).

More precisely.

The taxable amount is the amount left after you claim a deduction for all the expenses you can. These amounts reduce the amount of assessable income you pay tax on.

Australian Taxation Office

Assessable income − allowable deductions

= taxable income

So we have average taxable income and median taxable income. If we recall our statistics from high school average generally refers to the mean.

We calculate the mean by adding up all the values (in this case taxable incomes of Surgeons) and divide the sum by the total number of values (the number of Surgeons who completed a tax return). The median is calculated by listing all numbers (taxable incomes) in ascending order and then locating the number in the centre of that distribution.

Now. I’m only speculating here. But the most likely answer to why the big difference is variance.

And this is borne out when you look at some of the more detailed tables below.

Whilst the ATO doesn’t help us out with confidence intervals or ranges. It’s most likely that the statistics for Surgeons are more skewed by a small but significant group of Surgeons doing particularly well as some of the highest paid doctors in the country.

Another way to look at it is. Working in Anaesthetics you can make some really good but steady income. But you are probably less likely to be declaring $1million per annum. Whereas as a Surgeon you are more likely to have that opportunity.

And of course, we need to also account for the fact that the ATO does not collect statistics on hours of work. It’s a safe bet that many doctors are doing more than 40 hours a week. But there will be a number who will also be working part-time. We know that different occupations in medicine tend to have different percentages of doctors who work full time versus part-time. So this will have some impact as well.

For example in a fairly recent Australian Institute of Health and Welfare Report average weekly hours worked across 20 specialties varied from 38.2 hours per week (Psychiatrists) to 54.1 hours per week (Intensive Care Physicians).

When We Look Even Further Australian Doctors Are Almost Universally Well Paid

As I said the last time I blogged about these statistics I had lots of questions about different scenarios. Like what if I am this particular type of Surgeon? Or you haven’t talked about Pathologists. Or what about if I work privately versus publicly.

So let me attempt to address as many of your questions as possible in the next 3 tables.

Firstly below I have listed the top 51 occupations by taxable income in Australia for 2018 to 2019 again according to the ATO. Why 51? Well. If you go through this table you will see that 32 of the 51 occupations here are medical practitioner occupations.

So medical practitioners also occupy 32 of the top 51 occupations in Australia.

[ninja_tables id=”126336″]Now. What you might be surprised to know is this. There are only 2 other medical occupations that are not on this list. Which are 253000 Doctor – Specialist – type not specified, which sits at 217 at $137,480 Average Taxable Income and 253112 Medical Officer – Resident which sits at 422 on the list at $107,191 Average Taxable Income. And arguably these are the two categories that will cover most trainee doctors.

The list is of occupations is 3535 long by the way. So even if you are a Medical Officer – Resident you are already sitting in the top 12%.

And if you are a specialist you are doing very well in comparison to most other occupations.

So if you have a particular thesis that a certain occupation in medicine is poorly done by. Then I’m sorry to burst your bubble. But the data doesn’t support you. At least if you are comparing doctors to the rest of Australia.

Another way of putting it would be that the highest paid doctors in Australia are doctors. But clearly to paraphrase George Orwell. Some doctors are more highest paid doctors than other doctors.

The Highest of the Highest Paid Doctors in Australia Are Proceduralists

Have a look at the top of the table. Neurosurgeons have the highest average taxable income in Australia at $575,687 AUD. Then come Ophthalmologists, ENT Surgeons, Cardiologists, Urologists, Orthopaedic Surgeons, Plastic Surgeons, Vascular Surgeons and Gastroenterologists.

It’s only at number ten that a non-medical practitioner occupation makes an appearance. And that’s Judges!

What do the top nine all have in common? They perform procedures. There is a common conception that if your medical specialty includes significant procedural work (for which you can bill) you will do better from a monetary perspective. And here is some evidence that supports that idea, i.e. the highest paid doctors are procedural doctors.

If we go down the list further. The next 6 specialists are also involved in procedures. It is not till we hit Medical Oncologist on the list at 17 that we encounter a medical specialist who arguably does not have the opportunity to perform a lot of procedures.

Oh. And then we hit our next non-doctor at 18. The Financial Investment Manager.

I am often asked by international medical graduates which specialties are hard to get into in Australia. With the exception of Radiologists and perhaps Oncologists. This list of the top 18 highest paid doctors is a good reference of specialties where you are more likely to struggle.

Another 6 medical occupations (total of 24) come before State Governors at 28 on the list of highest paid occupations. (I’m also wondering how there are 23 returns for State Governors, given there are only 6 States, 2 Territories and one Commonwealth?)

General Physicians make on average slightly more than Magistrates and Psychiatrists are only just beaten by Members of Parliament. There are only 3 medical occupations that make less on average than Dentists and Cricketers.

Surprisingly, General Practitioner is not last on the list of Medical Practitioners. Its Pathologist.

Which Doctor Occupation Am I In?

Now you may be wondering what is covered by these doctor groups. As I said I got lots of questions about this last time.

To understand the way the ATO classifies occupations we need to refer to the ANZSCO classification system.

The Australian and New Zealand Standard Classification of Occupations (2013 version 1.3) is a joint collaboration between the Australian Bureau of Statistics (ABS) and its New Zealand counterpart, StatsNZ.

According to the ABS:

ANZSCO provides a basis for the standardised collection, analysis and dissemination of occupation data for Australia and New Zealand. The use of ANZSCO has resulted in improved comparability of occupation statistics produced by the two countries.

ABS

ANZSCO has a 5 level hierarchy starting with Major Groups, Sub-Major Groups, Minor Groups, Unit Groups and finally Occupations.

So when the media claims that Surgeons are the highest-paid occupation in Australia they are technically not correct. They should be referring to Neurosurgeons (see below).

There are 8 Major Groups

- Managers

- Professionals

- Technicians and Trade Workers

- Community and Personal Service Workers

- Clerical and Administrative Workers

- Sales Workers

- Machinery Operators and Drivers

- Labourers

With the notable exception of perhaps medical administrators (who perhaps are technically classified under Managers), all other medical practitioners are classified under Professionals > Health Professionals > Medical Practitioners.

I also suspect however that Directors of Medical Services and the like do not classify themselves as Medical Administrators as the average taxable income of $55,000 really does not make sense for this occupation. So I suspect they are selecting another medical occupation when completing their tax return.

This brings me to an important point. The ATO doesn’t audit (as far as I know) what occupation you put down on your tax return. So there is an element of discretion here.

On this point. It’s possible that some university academic doctors also elect to classify themselves as Educational Professionals > Tertiary Education Teachers > University Lecturers and Tutors.

But returning to our classification of Professionals > Health Professionals > Medical Practitioners. Medical Practitioners is the Minor Sub Group.

The Occupational Groups below this Minor Sub Group with their Occupation Sub Set are:

| Occupation Group | Occupations | Other Titles or Specialisations |

| 2531 General Practitioners and Resident Medical Officers | 253111 General Practitioner 253112 Resident Medical Officer | General Medical Practitioner Medical Intern |

| 2532 Anaesthetists | 253211 Anaesthetist | Intensive Care Anaesthetist Obstetric Anaesthetist Pain Management Specialist |

| 2533 Specialist Physicians | 253311 Specialist Physician (General Medicine) 253312 Cardiologist 253313 Clinical Haematologist 253314 Medical Oncologist 253315 Endocrinologist 253316 Gastroenterologist 253317 Intensive Care Specialist 253318 Neurologist 253321 Paediatrician 253322 Renal Medicine Specialist 253323 Rheumatologist 253324 Thoracic Medicine Specialist 253399 Specialist Physicians nec* | Intensive Care Medicine Specialist & Intensivist are alternative for Intensive Care Specialist The only specialisation options for paediatrician are Neonatologist and Paediatric Thoracic Physician Occupations in the nec group include: Clinical Allergist Clinical Geneticist Clinical Immunologist Clinical Pharmacologist Geriatrician Infectious Diseases Physician Musculoskeletal Physician (NZ) Occupational Medicine Physician Palliative Medicine Physician Public Health Physician Rehabilitation Medicine Physician Sexual Health Physician Sleep Medicine Physician |

| 2534 Psychiatrists | 253411 Psychiatrist | Specialisations: Adolescent Psychiatrist Child and Adolescent Psychiatrist Child Psychiatrist Forensic Psychiatrist Geriatric Psychiatrist Medical Psychotherapist |

| 2535 Surgeons | 253511 Surgeon (General) 253512 Cardiothoracic Surgeon 253513 Neurosurgeon 253514 Orthopaedic Surgeon 253515 Otorhinolaryngologist 253516 Paediatric Surgeon 253517 Plastic and Reconstructive Surgeon 253518 Urologist 253521 Vascular Surgeon | Alternative Titles for Otorhinolaryngologist are Ear, Nose and Throat Specialist Head and Neck Surgeon |

| 2539 Other Medical Practitioners | 253911 Dermatologist 253912 Emergency Medicine Specialist 253913 Obstetrician and Gynaecologist 253914 Ophthalmologist 253915 Pathologist 253917 Diagnostic and Interventional Radiologist 253918 Radiation Oncologist 253999 Medical Practitioners nec | Specialisations for Pathologists are: Clinical Cytopathologist Forensic Pathologist Immunologist Occupations under Medical Practitioner nec are: Nuclear Medicine Physician Sports Physician |

*nec = not elsewhere classified

In any case, you can now go look up the code that best represents your specialty and get some more detailed information of your earning potential from either the table above or the next one below. I’d recommend the next one.

And if you still can’t find yourself on the list. Feel free to have a wander through the ANZSCO information yourself.

The Highest Paid Doctors in Australia Are Men

You may not be all that shocked to know that male doctors do better than their counterparts.

What shocked me however was the extent to which this occurs. Try clicking on ‘M’ and ‘F’ and leaving ‘Total’ off on the table below.

[ninja_tables id=”126342″]You see a wall of blue.

Click on the pagination tabs to see some pink.

If we filter for M & F and Neurosurgeon we get the following result:

What’s most curious to note here is that the 30 female Neurosurgeons almost match their 150 male colleagues in terms of average wage income. This would indicate to me that they are earning similar salaries from public health service roles. In fact, the median salary or wage result tends to indicate to me that proportionately female Neurosurgeons might be working more in the public health system than their male counterparts. It’s clearly non-salary or wage income that is making the difference here.

This will undoubtedly be partly related to other income through operating a private service. But is probably also due to income from other sources such as investments.

This leads to the following result. In the top paid occupation in Australia, men more than double the average taxable income of women.

And it’s the same result for each specialty. There’s not one specialist occupation in Medicine where women do better than men in terms of average taxable income.

How Does this Income Compare to Salary Information?

Most general practitioner specialists and trainees work in the private sector in Australia. As do a significant number of other specialists. So the ATO data will reflect that many doctors are working for themselves on a fee for service or contractual basis. If a doctor wants to earn a more regular income or salaried wage then they will generally opt to find employment in the public hospital system as a Staff Specialist.

As a point of reference to the ATO data, a full-time employed Staff Specialist in the NSW Health system will generally be earning between $246059 and $303643 depending on their year’s of experience and level of seniority. Although they may earn as much as $484799 if they opt to split their private billings with the health service.

So whilst you clearly need to be doing some private practice to hit the top of the income tables. You can see that for most specialties you can actually do better than the average amongst your peers by working in public.

In a future post, I will update you on the salaried rates of pays for trainee doctors.

Leave a Reply to Mohamed Cancel reply